Deal Complexity

This engagement involved a sell-side due diligence project for a SaaS-based business platform, which added an additional layer of intricacy due to the involvement of a sell-side investment banker. The financial data environment was especially complex, with revenue records being maintained across multiple accounting systems as well as internally developed management spreadsheets, leading to significant challenges in data consistency and traceability.

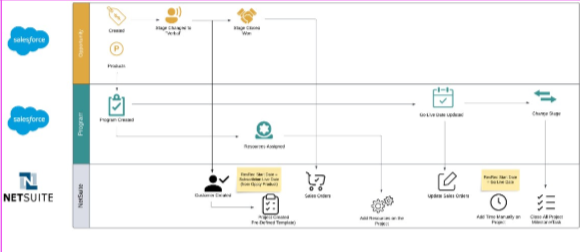

During the period under review, the target company had undergone a system migration—transitioning its accounting platform from QuickBooks to NetSuite. This shift resulted in a number of reclassifications and substantial changes in the chart of accounts, further complicating the financial analysis and requiring careful mapping and reconciliation of historical and current data sets.

The SaaS nature of the business also required a detailed breakdown of recurring versus non-recurring revenue, understanding deferred revenue recognition patterns, and accurate cash-to-accrual adjustments—all critical for presenting a clear financial picture to potential investors.

Windy Street’s Contribution

The Windy Street team took complete ownership of the project, managing the entire due diligence process remotely from India. Despite being offshore, we ensured full integration with the client and stakeholders through consistent, high-quality communication and active participation in all critical interactions.

Our responsibilities included:

End-to-end deal management from initial data requests to final report submission.

Full participation in all key discussions, including management calls, banker calls, and debrief sessions with client leadership.

Conducted an in-depth analysis of revenue streams, dissecting each element of recurring revenue, evaluating customer retention trends, and performing accurate cash-to-accrual conversions to normalize reported revenue.

Performed detailed Quality of Earnings (QoE) and Net Working Capital (NWC) analyses, ensuring transparency and credibility of the financial metrics.

Delivered a comprehensive due diligence report covering all major aspects including:

- Transaction Overview

- Key Financial Findings

- Quality of Earnings

- Net Working Capital

- Recurring Revenue Analysis

- Financial Highlights

- Supporting Appendices with reconciliations and documentation

By proactively identifying and resolving inconsistencies across systems and accounts, we ensured the seller could present a clean, investor-ready set of financials.

Client Testimonial

“Communication through daily emails and recurring check-in calls facilitated great transparency and alignment from our side. In addition, there was a large quantity of manual clean-up and reconciliations required, which was handled extremely well by the Windy team. Their deep dive into the Quality of Earnings and NWC analysis helped our client—on the sell-side—showcase a strong and defensible financial story to potential buyers.”

Conclusion

Windy Street’s involvement ensured a smooth, accurate, and value-driven due diligence process, allowing the client to navigate the sell-side transaction with confidence. By managing the entire engagement from offshore while maintaining clear communication and exceptional work quality, we helped maximize deal readiness and enabled the seller to put forth solid, credible numbers during buyer presentations and negotiations.