Company Overview

The client is a U.S.-based healthcare organization that specializes in higher-acuity surgical procedures, including but not limited to total joint replacements, spine surgeries, and cardiovascular interventions. The company operates through a network of surgical and medical centers strategically located across multiple states, offering both outpatient and inpatient care services. With a focus on advanced and specialized medical care, the organization has positioned itself as a key provider in the surgical healthcare segment.

Transaction Volume and Operations:

Established in 2017, the company handles a substantial volume of financial transactions on a daily basis. These transactions are generated through various channels of payment, including cash, self-funded cheques, payments from insurance companies, and Electronic Fund Transfers (EFT). The diverse nature of these payment methods contributes to the complexity of the company’s accounting processes.

Furthermore, the organization functions through multiple legal entities operating across various locations. Each of these entities records revenue at the end of the month. At month-end, the recognized revenue is matched and compared against the “Cash-log” maintained for the same period to identify any discrepancies or mismatches. Any variances between the recorded revenue and cash receipts are thoroughly investigated to detect any material misstatements or missed receipts. Once identified, receipts are classified and attributed to the correct practitioner and specific medical procedure to maintain accuracy in financial reporting.

Complexity

Handling Complex Accounting Transactions:

The revenue streams for the client are derived from both high-value surgical procedures and routine doctor consultations. On any given day, multiple payments are received across the organization’s various centers. Each receipt must be carefully recorded in the accounting system and linked with a unique patient ID, along with the date of receipt and department where the service was rendered. Given the sheer volume of transactions and the sensitivity of healthcare data, the organization’s accounting function is required to maintain a high level of precision and reliability in transaction processing.

In addition to transaction-level complexities, the organization also deals with a nuanced cost allocation framework. Certain administrative expenses need to be apportioned across various practitioners based on pre-agreed percentages. These could include staffing costs, facility charges, or technology usage. There are also generic administrative expenses that are not attributable to any one practitioner or department, which are charged directly to the overall Income Statement. Managing this level of granularity in both revenue recognition and expense allocation adds another layer of intricacy to the financial reporting process.

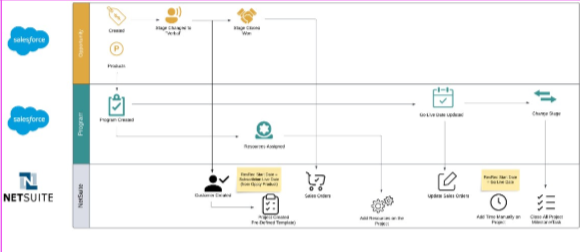

Windy Street Solution

Daily Transaction Recording and Reconciliation:

To bring structure and control to the process, Windy Street implemented a robust accounting workflow. Every individual receipt is tagged with the associated patient ID, department, and date of service. A daily reconciliation routine is followed to map the recorded receipts against actual deposits made in the bank accounts. This step ensures that each transaction is validated, and any inconsistencies—such as bounced cheques or failed EFTs—are promptly identified. These issues are then followed up by the accounts receivable team to ensure timely resolution and accurate financial tracking.

Monthly Revenue Reconciliation and Practitioner Mapping:

At month-end, revenue recognized across all entities is reconciled against the comprehensive Cash-log to detect and understand any variances. This ensures that all collections have been appropriately captured and mapped to the corresponding practitioner and medical procedure. This process minimizes the risk of leakage, omission, or misstatement of revenues.

Administrative Expense Allocation:

By ensuring that every receipt is properly categorized, Windy Street also enabled more accurate allocation of shared and practitioner-specific expenses. Departmental tagging played a crucial role in not only tracking revenue but also in aligning related expenses to the appropriate cost centers. As a result, the allocation of administrative overheads—both practitioner-specific and generic—became more transparent and compliant with internal accounting policies.

This structured approach provided the client with improved accuracy in revenue recognition, enhanced visibility into practitioner-level performance, and ensured alignment with accounting standards. Ultimately, it resulted in more reliable financial reporting and supported better decision-making at both the operational and executive levels.